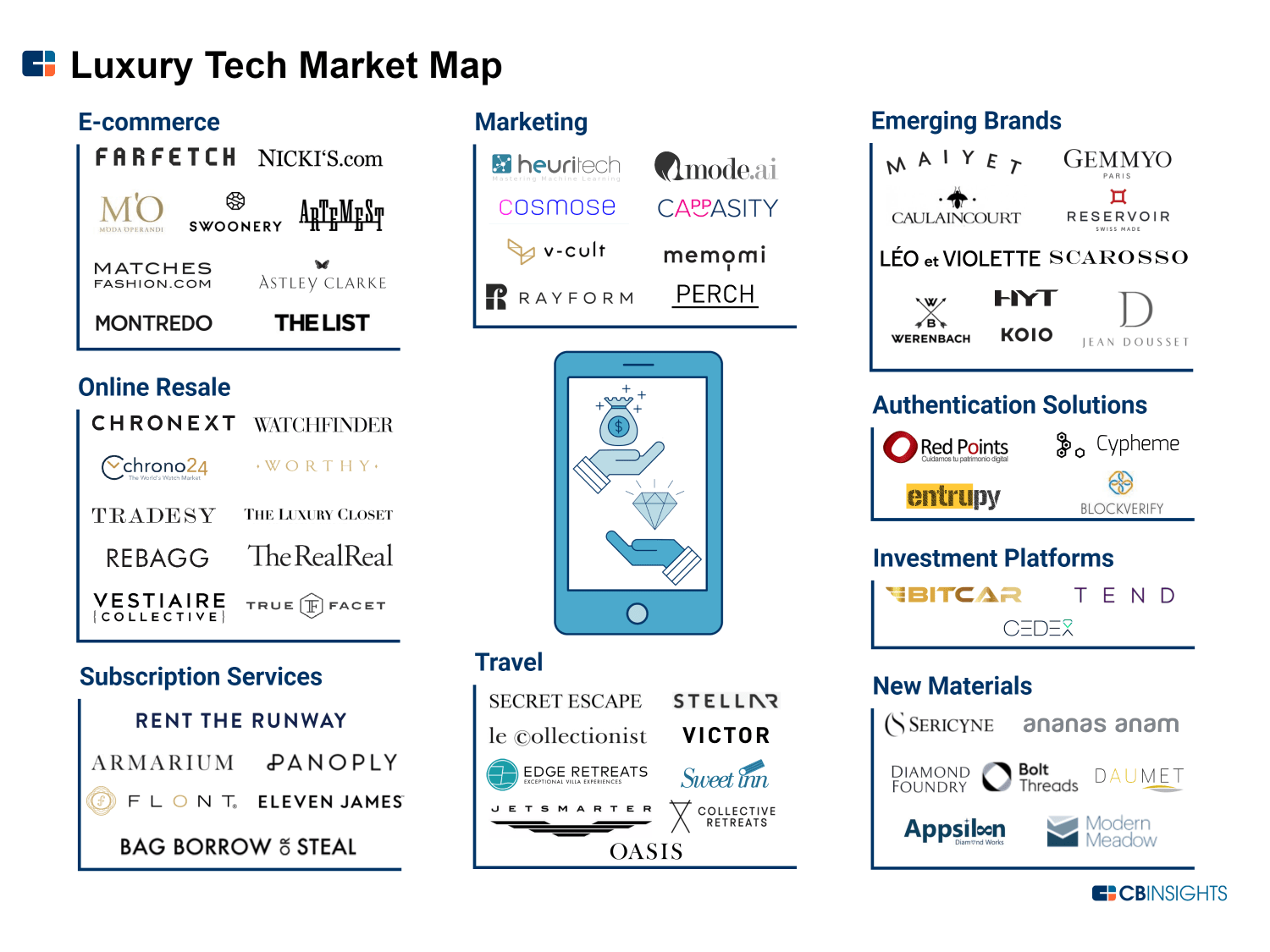

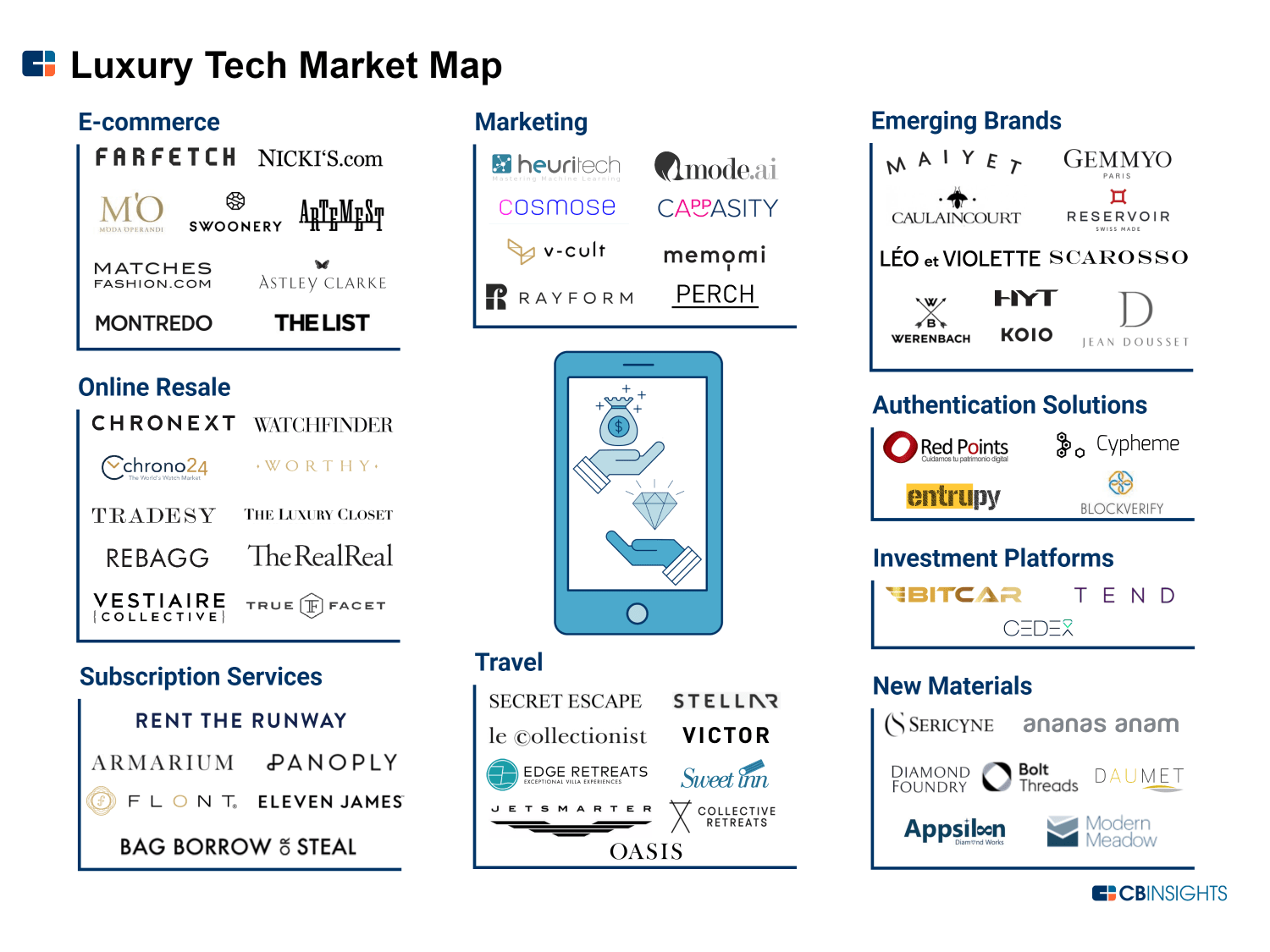

Luxury Tech Market Map: 65+ Startups Changing The Way We Buy, Sell, And Perceive Luxury - CB Insight

Global luxury houses such as LVMH and Prada have often been reluctant to adopt new technologies.

From subscription services to AI-powered authentication solutions and lab-grown diamonds, luxury tech startups are spurring innovation beyond e-commerce platforms.

Global luxury houses such as LVMH and Prada have often been reluctant to adopt new technologies. Recently, however, these luxury brands and many others have begun to explore e-commerce platforms and digital technologies.

Both LVMH and Prada launched new e-commerce sites in 2017, for example, and Richemont recently announced a $3.3B bid to fully acquire online luxury platform Yoox Net-a-Porter.

Dozens of startups targeting the luxury space have launched simultaneously. Some compete with luxury leaders by launching new brands of their own, and others aim to help incumbents by offering them luxury-specific technology tools. We see startups working on everything from lab-grown diamonds to luxury subscription services to blockchain for authenticating luxury products.

We used the CB Insights database to identify over 65 luxury tech startups and map them into 9 categories. The startups in the graphic below have raised $2.7B in total funding led by FarFetch, which has raised $701.5M.

The graphic includes private companies only and is not meant to be exhaustive of companies in the space. Categories are not mutually exclusive. Please click to enlarge.

We define luxury tech to include tech-enabled companies launching new luxury brands as well as startups providing tech solutions to the luxury industry, including e-commerce tools, marketing, and more. While these companies may not exclusively target luxury companies, they have notable luxury partners in their client roster. We exclude beauty and food companies.

Scroll down to see the full list of companies in the graphic.

CATEGORY BREAKDOWN

E-commerce — This category includes online platforms for buying luxury goods, and is the most well-funded category on our map. We see high-profile startups that sell a wide range of luxury products, such as FarFetch ($701M in total funding) and Moda Operandi ($293M in total funding), as well as specialized online shops such as watch-focused Montredo ($1.1M in total funding).

Marketing — These startups are leveraging new technologies to help luxury brands with marketing. France-based Heuritech raised $1.18M in Q1’17 to deploy its social media scanning solutions to help luxury companies spot trends from untagged images. Others are using AR/VR (Cappasity), chatbots (Mode.ai) and image-recognition tools (Heuritech) to assist luxury retailers.

Emerging Brands — Companies in this category are launching new luxury brands and selling direct-to-consumer. New York-based Maiyet offers ethical luxury apparel and accessories while HYT, Reservoir Watch and Werenbach Watches have launched new watch brands. Switzerland-based Werenbach Watches raised $790k in crowdfunding in Q2’17 to offer watches made from rocketship materials.

Authentication Solution — Startups in this category use new technologies to verify the authenticity of luxury goods. Companies like Entrupy and Red Points use artificial intelligence to detect counterfeit products, while Block Verify offers a blockchain-based solution using a tag on each product. Spain-based Red Points scans online marketplaces to detect fraud and counterfeit and raised a $12M Series B round this quarter.

Investment Platforms — These very early-stage companies are making investing in luxury goods easier and cheaper by offering users the ability to buy whole diamonds, parts of a diamond, or luxury watches with blockchain technology. Tend offers a platform on which users can invest in shares of luxury goods such as luxury cars, diamonds, and watches. Users then have access to their investment pieces for a set amount of time, similar to how a timeshare works. Other startups focus on a single asset, such as CEDEX with diamonds and Bitcar with luxury cars. All three startups are planning to raise initial coin offerings later this year.

New Materials — This category includes startups developing new, sustainable ways to produce luxury materials, such as lab-grown leather (Modern Meadow), plant-based leather (ananas anam), and lab-grown diamonds (Diamond Foundry). Bolt Threads, a fabric startup using protein fermentation to produce animal-free silk, has raised a total of $211M.

Travel — While Collective Retreats offers luxury tent accommodations in multiple locations across the US, London-based Victor has developed a marketplace for private jets users. Beyond luxury rentals and private jet startups, companies in this category also include flash-sale platform Secret Escapes, one of the most well-funded luxury travel startups with a total of $191M raised.

Subscription Services — Startups in this category operate on a subscription-based model, allowing users to pay a fee to rent luxury goods. Companies span apparel (Armarium), watches (Eleven James), and jewelry (Flont). New York-based Rent the Runway has raised the most money by far with $176M, and is reportedly planning an IPO.

Online Resale — These companies offer platforms to buy and sell second-hand luxury goods. This category has attracted over $500M in total funding, of which $172.6M was raised by California-based The RealReal. Vestiaire Collective is the second most well-funded startup in this category with $131.4M raised from Balderton Capital, Eurazeo, and others, offering pre-owned luxury goods to its 6 million members.